Buying a car is a big decision, and it’s even bigger if you’re financing the purchase. There are a lot of factors to consider, and it can be easy to get overwhelmed. That’s why we’ve put together this checklist to help you through the process.

1. Do your research.

The first step is to do your research and figure out what kind of car you want and how much you can afford. Consider your needs and budget, and compare different makes and models. You can use online resources like Edmunds and Kelley Blue Book to get pricing information and reviews.

2. Get pre-approved for a loan.

Once you know what kind of car you want, it’s time to get pre-approved for a loan. This will give you an idea of how much you can borrow and what your monthly payments will be. It will also put you in a stronger negotiating position when you’re shopping for a car.

3. Shop around.

Don’t just go to one dealership. Compare prices from different dealerships to find the best deal. You can also try to negotiate the price of the car. The sticker price is just a starting point. You may be able to get a lower price if you’re willing to haggle.

4. Read the fine print.

Before you sign any paperwork, be sure to read the fine print carefully. This includes the terms of the loan, the interest rate, and any other fees.

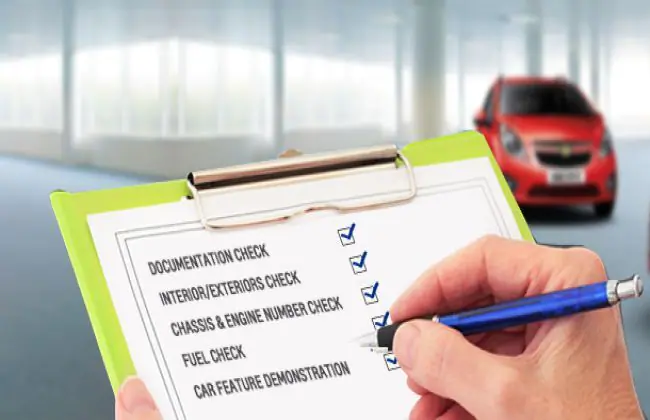

5. Get the car inspected.

Once you’ve agreed on a price, it’s important to get the car inspected by a mechanic. This will help you identify any potential problems with the car before you buy it.

6. Buy the car.

Once you’re satisfied with the car and the inspection, you can sign the paperwork and buy the car.

Here are some additional tips for buying a car with a loan:

- Consider a shorter loan term.

A shorter loan term will mean higher monthly payments, but you’ll pay less interest overall.

- Shop for a low-interest rate.

The interest rate on your loan will have a big impact on your monthly payments. Shop around for a loan with a low interest rate.

- Get a down payment.

A down payment will lower your monthly payments and the amount of interest you pay.

- Be prepared for unexpected expenses.

In addition to the car payment, you’ll also need to budget for car insurance, gas, maintenance, and repairs.

Buying a car with a loan can be a big decision, but it doesn’t have to be complicated. By following these tips, you can find the right car for your needs and budget.

Additional Tips

- Don’t be afraid to walk away.

If you’re not happy with the terms of the deal, don’t be afraid to walk away. There are plenty of other cars out there.

- Get everything in writing.

Once you’ve agreed on a price, get everything in writing. This includes the purchase price, the interest rate, the monthly payments, and any other fees.

- Don’t forget about the warranty.

Most new cars come with a warranty. Be sure to read the warranty carefully so you know what’s covered.

- Take care of your car.

Regular maintenance will help keep your car running smoothly and prevent costly repairs down the road.

Buying a car is a big investment, but it can also be a rewarding experience. By following these tips, you can make the process a little bit easier.